There is no denying that Covid-19 has impacted every facet of our lives and there is so much to learn from it.

The coronavirus pandemic causing a standstill for most economies and impacting the global stock market must be on everyone’s mind now. Even if the valuation is attractive, you are probably worried that the markets are looking shaky at the moment, and would prefer to wait for the “right time” before taking the plunge. Or perhaps you think you need to grasp the “holy grail of investing” before you can actually do anything with your money that remotely resembles investing.

One thing is for sure, it is a matter of time that the economy will recover. No time is good or bad for investing, it all boils down to grabbing the opportunity. Instead of thinking about how much value stocks are losing today, think about investing in the long-term.

The pandemic has taught us one lesson about creating multiple streams of income

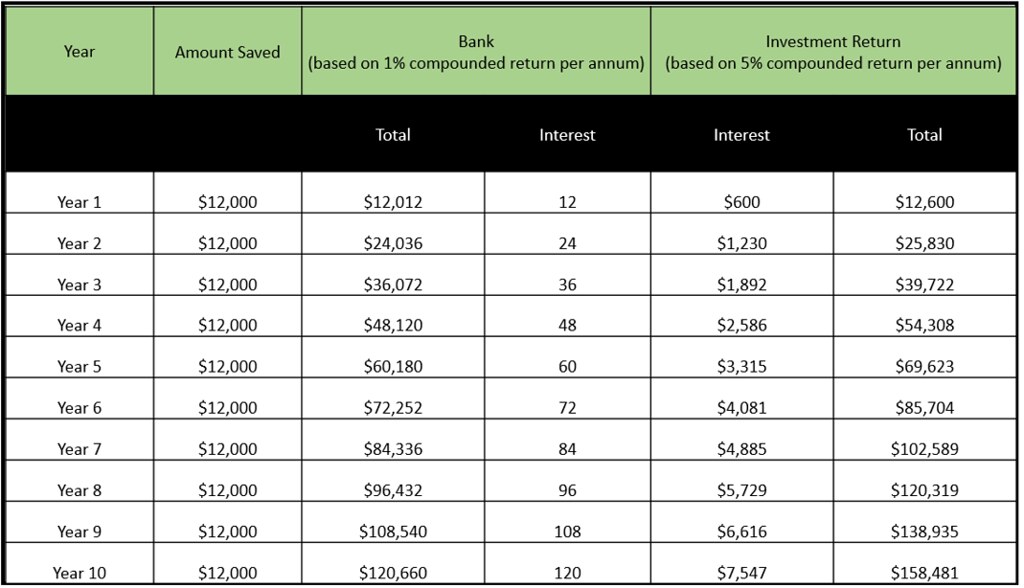

A picture speaks more than a thousand words. The illustration table below is akin to the principle of sowing and reaping. The sooner you put your dollars to work, the more you will benefit in the long run. In fact, what you invest can have a greater impact on the size of your nest egg than the amount you invest.

Need proof? Let’s say you start saving $12,000 a year. If you are risk averse and choose to let your savings ride it out with the bank’s mediocre rate, you would have just over $120,000 at the end of the tenth year. Now, let’s say you want to be an investor and start to chronicle your personal investment journey. All else being equal and assuming an average 5% annual return, you could potentially have about $159,000 after 10 years!

What are the investment options?

Saving money in your bank account is just the beginning of your investing journey. To stay ahead of inflation, you need to find investments that generate meaningful returns to stay ahead of inflation. There are various investment options to consider but we shall focus on the common ones such as stocks, REITS and ETFs. We will not get into the mumbo jumbo but delve straight into some salient features of these investment options.

Stocks or Equities

Equities refer to a stock of a company measured in number of shares. Shareholders earn returns when they receive dividends, which are paid out of the company’s profits. Instead of distributing their profits, some companies may choose to re-invest these gains into their business. Alternatively, when the current stock price rises above its purchase price over a period of time, shareholders can choose to sell the stock to lock in their profits.

The advantages of investing in shares include:

- Capital Gain (Selling price is higher than purchase price)

- Dividend Income (Share can pay us a revenue when we hold them)

- Liquidity (Unlike real estate, you have the flexibility to buy and sell shares quickly and easily when we want)

It is important to do your own due diligence when it comes to investing in shares. While capital and volatility risks are inevitable, one way to hedge yourselves is to invest in blue chip stocks which are fundamentally sound and typically lower risk.

Real Estate Investment Trusts (REITS)

How does it sound to become a landlord and collect rental income? When you invest in a REIT, you’re investing in the properties managed by that REIT. The revenues generated (primarily rental income) are normally distributed at regular intervals as dividend to REITs shareholders.

Notwithstanding the sharp sell-off of S-REITS due to Covid-19, they are generally perceived as defensive, income-generating investment that offer consistent and meaningful dividends. Investing in REITS is a good option when your motivation is planning for retirement or gaining passive income.

The broad categories of REITs you can invest in and the typical properties they own:

- Commercial REITs – office buildings

- Retail REITs – shopping malls

- Industrial REITs – warehouses, logistics facilities and data centres

- Hospitality REITs – hotels and serviced residences

- Healthcare REITs – hospitals and nursing homes

Do keep in mind the risks involved which include:

- Income Risk (Distributions are not guaranteed and are subject to fluctuations in the REIT’s income)

- Leverage Risk (REIT needs to ensure it does not use too much debt to finance acquisition of its properties)

- Land Lease Expiry Risk (The value of the REIT may be affected by the decreasing term or the expiry of the land leases, and this may result in a decline in the price of the units)

Exchange-Traded Fund

Another convenient way to diversify our investments is through Exchange Traded Funds (ETF). These are funds (or portfolios of company stock) that are bought and sold through the Singapore Exchange. ETFs are useful investment instruments for new investors who want stock diversification from relatively small outlays.

Some advantages of owning ETFs include:

- Liquidity (Choose to buy and sell shares anytime you want)

- Transparency (Price of the shares are made available for you to buy or sell)

- Cost-Effective (Own a basket of stocks which would otherwise be expensive to buy them individually)

Your Covid-19 Survival Guide

If you have cash preserved for this crucial period and not knowing where to start off in your personal investment journey, Moneysmart’s Covid-19 Survival Guide is not just timely-introduced but also serves as a one-stop-destination to get necessary information about investing.

While browsing the MoneySmart Covid-19 Survival Guide, the website comes forth as a useful resource for new investors who had little or no clue about where to start in investing. The browsing experience has been intuitive and the articles are concise, easy to read and most importantly, offer practical suggestions.

Instead of running helter-skelter, the Covid-19 Survival Guide is a life-saver. It provides easy to navigate, current and practical suggestions before you make the conscious decision to invest. You would know which site to bookmark and make a visit the next time you need information on finances.

At MoneySmart, you may not find ALL the answers – but you can at least get some advice on how to plan your finances responsibly to get through this.

We definitely are in an unprecedented point in history but we will all get through it together.

The ideas expressed in this blog should not be construed as an enticement to buy or sell securities, commodities or assets. The accuracy or completeness of the information provided cannot be guaranteed. Readers should carry out independent verification of information provided. No warranty whatsoever is given and no liability whatsoever is accepted for any loss howsoever arising whether directly or indirectly as a result of actions taken based on ideas and information found in this blog.